All Categories

Featured

Table of Contents

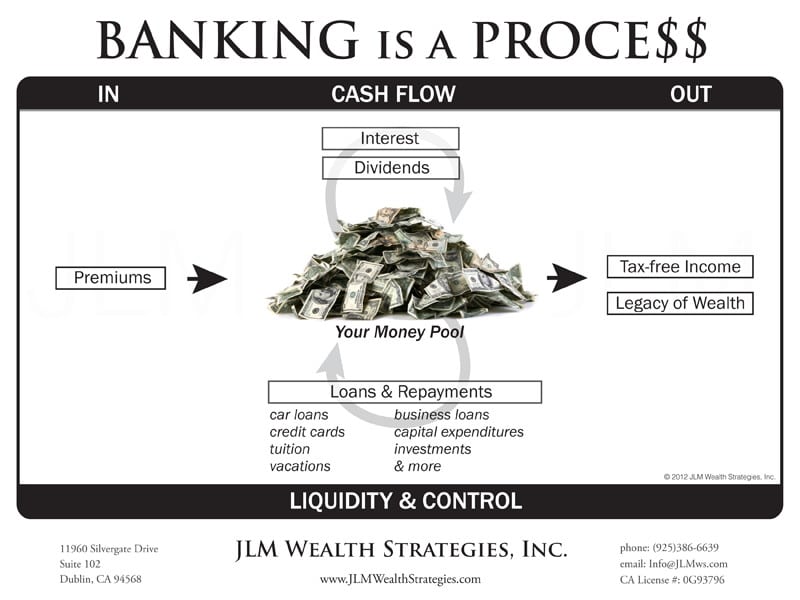

Imagine having that interest returned to in a tax-favorable account control. What chances could you benefit from in your life with even half of that money back? The keynote behind the Infinite Financial Idea, or IBC, is for people to take more control over the funding and financial features in their everyday lives.

By having your dollar do more than one task. Currently, when you spend $1, it does one thing for you. Perhaps it pays a bill.

What if there was an approach that shows individuals just how they can have their $1 do than one task simply by relocating it via an asset that they control? This is the significance of the Infinite Banking Principle, initially championed by Nelson Nash in his publication Becoming Your Own Banker.

In his publication he shows that by producing your own exclusive "banking system" through a particularly designed life insurance policy agreement, and running your dollars via this system, you can substantially improve your monetary scenario. At its core, the principle is as simple as that. Creating your IBC system can be performed in a variety of creative ways without altering your capital.

This is component of the procedure. It takes some time to grow a system to take care of everything we want it to do. Assuming long term is crucial. Simply bear in mind that you will certainly remain in monetary scenario 10, 20 or perhaps thirty years from now. To get there we must start somewhere.

The repayments that would have or else gone to a financial establishment are paid back to your personal pool that would have been made use of. More cash goes right into your system, and each buck is carrying out multiple tasks.

R Nelson Nash Infinite Banking Concept

This money can be used tax-free. You have complete accessibility to your funds whenever and for whatever you desire, without fees, charges, review boards, or added security. The cash you use can be paid back at your recreation with no set repayment schedule. And, when the time comes, you can pass on everything you have actually accumulated to those you enjoy and respect entirely.

This is how households hand down systems of riches that allow the next generation to follow their desires, start services, and capitalize on possibilities without shedding it all to estate and estate tax. Firms and financial institutions utilize this approach to create working swimming pools of capital for their companies.

Walt Disney utilized this technique to start his dream of building an amusement park for children. We 'd enjoy to share a lot more examples. The concern is, what do desire? Tranquility of mind? Financial security? A sound financial option that does not depend on a rising and fall market? To have cash money for emergencies and possibilities? To have something to pass on to the people you enjoy? Are you going to find out more? Financial Preparation Has Failed.

Join one of our webinars, or attend an IBC boot camp, all for free. At no charge to you, we will certainly teach you more about how IBC works, and develop with you a plan that functions to address your trouble. There is no commitment at any kind of point while doing so.

Become My Own Bank

This is life. This is tradition. Get in touch with among our IBC Coaches right away so we can show you the power of IBC and entire life insurance policy today. ( 888) 439-0777.

We've been aiding families, company owner, and people take control of their funds for years (non direct recognition life insurance). Today, we're thrilled to revisit the fundamental concepts of the Infinite Banking Principle. Whether you're managing individual financial resources, running a service, or preparing for the future, this idea supplies an effective tool to achieve financial goals

A common false impression is that infinite financial rotates around getting life insurance policy, but it's actually about controlling the procedure of funding in your life. Nelson Nash, in his book Becoming Your Own Lender, makes this clear. The core idea is that we finance every little thing we buyeither by obtaining money and paying interest to another person, or by paying cash money and losing on the interest we can have gained somewhere else.

Some might assert they have an "unlimited banking policy," yet that's a misnomer. While particular policies are developed to implement the Infinite Banking Principle, Nelson uncovered this procedure making use of a traditional entire life insurance plan he had actually purchased back in 1958.

Nelson obtained a declaration for his State Farm life insurance plan. He saw that for a $389 costs, the cash value of the plan would certainly boost by virtually $1,600.

This awareness noted the genesis of the Infinite Banking Concept. Several people stay at the grace of changing rate of interest prices on home mortgages, home equity lines of credit score, or service loans.

Whole Life Insurance For Infinite Banking

Nelson acquired his plan for its fatality advantage. Over time, the money value expanded, producing a monetary source he might touch into via policy fundings. His background as a forester provided him a distinct long-lasting viewpoint; he thought in terms of years and generations.

Nelson was investing in a policy that would not have cash value for two or 3 years. This brings us to the essence of the Infinite Financial Principle: it's regarding how you use your cash.

With your own swimming pool of money, the possibilities are limitless. There's an important action: playing the straightforward lender. This indicates valuing your cash the same method a bank values theirs. Whether you're borrowing from your policy or settling it, treat it as if you were working with a standard loan provider.

When financial institution loans were at 2-3%, some selected not to obtain against their plans. As bank rates climbed to 8-10% while plan lendings stayed at 5%, those with foresight and a well-structured policy enjoyed the liberty to obtain on much more favorable terms.

Notably, boundless financial doesn't need way of living sacrifices. It has to do with making smarter options with the cash you already spend. Rather than relying upon outside financing, you money your buy from your very own swimming pool of cash money, preserving control and versatility. This system can take place forever, benefiting you and future generations. Starting is easy: start where you are.

At its core, unlimited financial enables one to leverage one's cash money value inside their entire life insurance plan rather of counting on typical funding from banks or various other lenders. "Insurance coverage," in this situation, typically refers to, which covers an individual's entire life (in comparison to, which only covers the insurance policy holder's recipients in the occasion of fatality).

Infinite Banking Concepts

Insurance firms usually process such demands easily because the security is already in their hands. They can quickly take ownership of it if the insurance holder defaults on their payments. Best of all, the system presents huge tax financial savings considering that dividends from cash-value life insurance policy policies are exempt to earnings tax obligation.

Latest Posts

Private Family Banking Life Insurance

What Is Infinite Banking Concept

Becoming Your Own Banker: Unlock The Infinite Banking ...